A Forex Market Jargon Called Currency Pair

A large part of the financial market constitutes FOREX or Foreign Exchange that is basically an over-the-counter market used to trade the numerous currencies of the world. The Forex market continues to have the highest trading volume. The Forex market can be distinguished into three major regions—Europe, Australasia and North America. These, in turn, contain several major financial hubs. This market completely revolves around the currency pairs.

A large part of the financial market constitutes FOREX or Foreign Exchange that is basically an over-the-counter market used to trade the numerous currencies of the world. The Forex market continues to have the highest trading volume. The Forex market can be distinguished into three major regions—Europe, Australasia and North America. These, in turn, contain several major financial hubs. This market completely revolves around the currency pairs.

Breaking Down “Currency Pairs”

In a currency pair, the value of one currency is calculated on the basis of the other currency. A forex trade usually involves simultaneously buying one currency and selling another. In case of a forex market, the trader can purchase and trade the currency pair as a single unit/instrument. Let’s take the example of the currency pair EUR/USD. EUR, in this case, will be termed as the base currency and USD is the quoted currency. When purchasing the currency pair the trader has to pay the price of the base currency and sell the quoted currency (the price is not fixed, it is prior to change according to the market sentiment). The bid price reflects the amount of quote currency the trader needs to have to get one unit of the base currency. While selling the currency pair, the trader will get the quoted currency and sell the base currency. The ask price reflects the amount of quote currency the trader will get by selling one unit of the base currency.

In the EUR/USD pair, let’s say the quotation price is 1.5000. This means that if this currency pair trades at 1.50, the cost of 1 Euro is equivalent to 1.5 U.S. dollars. It can also be seen in this way- the trader has to pay $150 to buy 100 Euros.

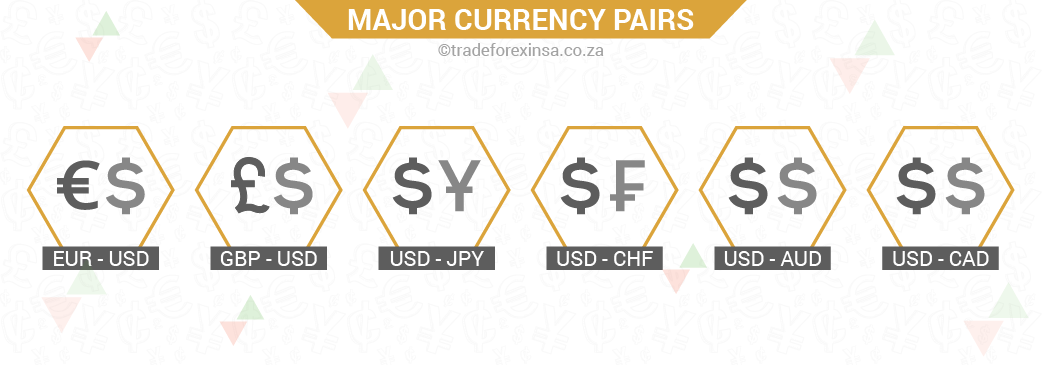

Major Currency pairs

Trading Currency Pairs from South Africa

As such, there is no such restriction for a South African trader to trade a particular currency pair in the forex market. However, the trader has to first check with its broker whether it offers all the known currency pairs or only a select few. EUR/USD, USD/JPY, GBP/USD, AUD/USD, USD/CHF and USD/CAD are some of the popularly known forex currency pairs and according to some market analysts are the most liquid currency pairs. There is no such pair called USD/EUR due to historical reasons in the Forex market. Some of the popular currency pairs even sport nicknames. For instance, the EUR/USD pair is known as ‘the Chunnel’, GBP/USD as ‘the cable’, EUR/GBP as ‘the Loonie’, and USD/CAD as ‘the Funds’. These are useful for interpreting and understanding trading discussion as the traders often use these nicknames.

The South African trader also has the opportunity to trade ZAR/MXN (South African rand and Mexican peso), ZAR/JPY (South African rand and Japanese yen), and USD/ZAR (U.S. dollar and South African rand) from their hometown.

Major Currency Pairs in the Forex Market: The currency pairs are ranked according to the 24-hour or daily trading volume in the forex market. It has often been observed that the U.S. dollar currency pairs top the list. Other than the USD pairs, EUR/GBP, EUR/CHF and EUR/JPY are some of the popular pairs in the forex trading world. All of the popular U.S. dollar currency pairs usually have highly volatile markets and trade throughout the day on any business day. They also have narrower spreads.

Minor and Exotic Currency Pairs in the Forex Market: The currency pairs that have no relation with the U.S. dollar (no matter how popular they are) are referred as the minor currency pairs or crosses. Unlike the majors, they have slightly wider spreads. And, their market is also not as volatile as that of the major currency pairs. But, this does not mean that they have a low volatile market. The examples of crosses include EUR/GBP, GBP/JPY and EUR/CHF. The cross currency pairs have the potential to expand the trading possibilities in the forex market even though they are not so actively traded (low trading volume). Exotic currency pairs are pairs from the ‘developing’ or ‘emerging’ markets. These have comparatively larger spreads and their market is not so liquid. USD/SGD (U.S> dollar/Singapore dollar) is one such example of exotic currency.

A Brief Introduction to Direct and Indirect Currency Quotes

The process of quoting a currency pair can be direct or indirect. If the domestic currency is the quoted currency then it is a direct currency quote while the indirect quote indicates that the domestic currency is the base currency. So, if the South African trader is looking at ZAR as the domestic currency and is trading ZAR/JPY then, it is an indirect quote. But, if s/he is trading JPY/ZAR then it is an instance of the direct quote. Therefore, the direct quote keeps the foreign currency fixed at one unit and the price of the domestic currency is calculated in comparison to the foreign currency. On the other hand, in an indirect quote, the domestic currency is fixed at one unit and the foreign currency is calculated in comparison to the foreign currency. In the first case, the domestic currency is variable while in the second case the foreign currency is variable.

What is Bid and Ask?

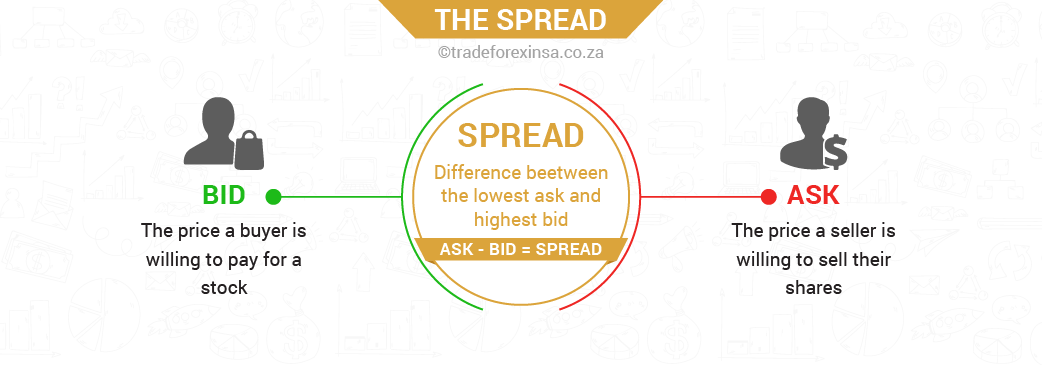

The bid price is basically the price at which a currency pair or an asset is purchased and the ask price is the selling price. Both of these terms are quoted in terms of the base currency of a pair. In case of Buying a currency pair, the ask price is the amount of quoted currency that the trader has to pay to buy a unit of the base currency. The bid price, on the other hand, is the amount of the quoted currency the forex trader will get on selling a unit of the base currency. For instance, the price of a currency pair is shown as 1.2000/05. Then, the bid price is 1.2000 and the ask price is 1.2005.

Currency pairs, apart from the forex market are also traded in the forwards and futures market. The major difference lies in the way it is quoted in both the markets. In the futures and forwards market, the foreign exchange will be quoted against the U.S. dollar always. In simpler words, the bid and the ask price is determined by comparing its present price with the present price of the U.S. dollar. The currency pairs, thus constitute an essential part of the futures, forwards and forex market.

The Spread