IQ Option Tutorial – Our Detailed Guide

IQ Option is a well-known website for Binary Options trading. You can trade various types of assets on this trading platform including CFDs on forex, stocks, commodities, crypto, ETFs, and indices. The platform offers a number of indicators allowing its clients try a wide variety of trading methods. However, too much information can be overwhelming, especially for beginners. So, you may visit the blog and the wiki of the platform to learn about trading better and go through the tutorials.

IQ Option is a well-known website for Binary Options trading. You can trade various types of assets on this trading platform including CFDs on forex, stocks, commodities, crypto, ETFs, and indices. The platform offers a number of indicators allowing its clients try a wide variety of trading methods. However, too much information can be overwhelming, especially for beginners. So, you may visit the blog and the wiki of the platform to learn about trading better and go through the tutorials.

Overview:

- Minimum Deposit: Real a/c- $10

- VIP Account available

- Max. Leverage: Stocks- 1:20, Forex- 1:500, Crypto- 1:5 (T&Cs apply)

- Max. Return: Up to 100% (in case of correct prediction) for Binary Options *

- Tradable Assets: Stocks over 190, Forex over 30 pairs, Crypto- 12

- Demo Account: Yes

RISK WARNING: YOUR CAPITAL MIGHT BE AT RISK

Why do you need an IQ Option tutorial?

If you are a beginner in Binary Options trading, then you should follow an IQ Option tutorial so you can understand the platform better. The team at IQ Option is very active and they update the website on daily basis. So, it is important to have the basic knowledge to understand the platform. This is why IQ Option tutorial is essential for you.

IQ Option PDF tutorial

You can learn binary options trading with free IQ Option PDF tutorial package. To get this package, all you have to do is sign up with IQ Option. After that, you can download the PDFs and the app to start online binary trading.

RISK WARNING: YOUR CAPITAL MIGHT BE AT RISK

IQ Option video tutorials

You can learn about binary option fast at free of cost from the IQ Option tutorial videos. The broker offers many tutorial videos that can help you learn how to use the trading platform to trade binary options. The tutorial videos are

- Forex. How to start?

- What is CFD?

- How to trade CFD?

- What is leverage?

- How to calculate profit in CFD trading?

- How to close your position automatically?

- How to open your position automatically?

- How to keep a position open even at 95% loss?

- What is slippage?

- What is overnight funding?

IQ Option Platform guides

How to use the platform

To sign in and trade on the IQ Option platform, the trader first has to specify personal information and email. After that, they may select the type of account they want. It can be either a demo account or a real account. After opening the account, you will be able to see the main window.

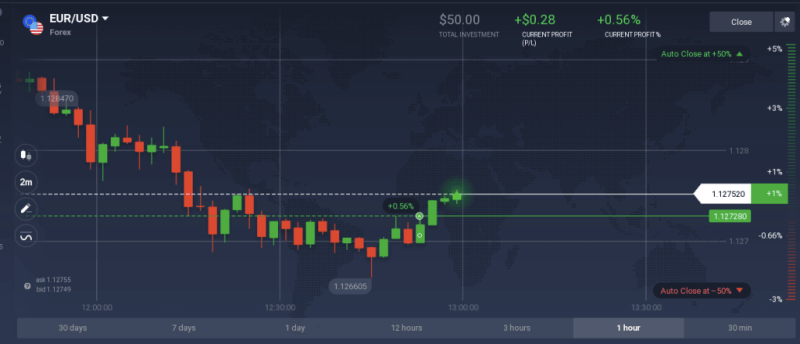

There would be a chart on this window that shows real-time price movements of the selected assets. The trader can buy options even before the buy moment arrives. Expiration time indicates the moment when the option expires. The page also shows all assets including currency pairs, commodities, indices, and equities under the menu of assets. The expected profit is indicated as a percentage. The tools of analysis are provided at the bottom left corner, in the technical analysis panel. Just above the technical analysis panel, there is an option to select the type of chart. In the trading panel at the top right corner of the window, there is the trading panel where the traders can view the time when the option will be expired. By viewing the price of the asset, you can either choose the “Call” option or the “Put” option. A call option means that the price will go higher than the moment of purchase, while the put option means that the price will go lower. In the case of right prediction, you will find the expired options, the options yet to expire, along with top traders’ stats, relevant financial news, and technical analysis at the left panel of the window. There is an account management menu where the trader can change personal information, manage deposit and withdrawal, and view transaction history and trading history. Before making a deposit, you have to choose the payment method.

Account verification

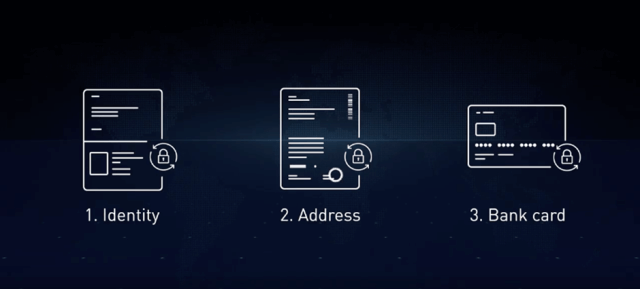

To trade on IQ Option, you must verify your account by verifying your identity, address, and bank card that you will use for transactions.

- Identity verification: You will have to provide a photo or a scan of your identity card or passport.

- Address verification: To verify your address, you need to provide a scan or a photo of a statement for a credit card or a bank account, account bill for utility services, document from the municipality with an official stamp, or a tax statement.

- Bank card verification: To prove your ownership of the bank card, you will have to provide a photo or a scan of both sides of the card containing your name on both sides.

Keep in mind that all documents must be current and updated.

Account settings

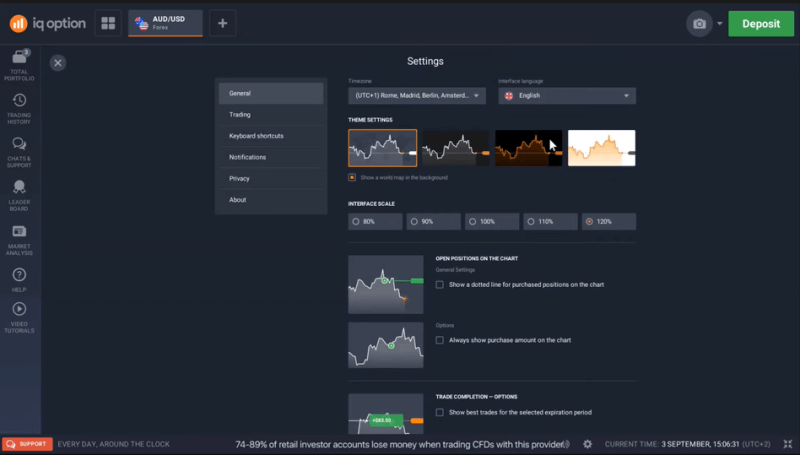

To change the settings of your account, you have to click on the “Settings” icon in the lower panel of the chart in the trading window or on the profile icon at the top right corner and select “Settings”.

You can change the time zone, interface language, colour scheme, interface scale, and specify which information should be displayed on the chart and which should be hidden in the general settings. In trading settings, you can enable the trade completion feature, single click for opening and closing positions, and manage other settings. Keyboard shortcuts help you to navigate through the platform faster and easier by adjusting the settings of windows and panels, chart views, and chart types. You can customize the notifications of the platform under the notifications settings. Privacy settings allow you to manage which information you want to show to other users, and which you want to hide. In the about section, you can view which version of the platform you are using.

How to customize IQ option platform

You can customize the trading platform of IQ Option from account settings as well.

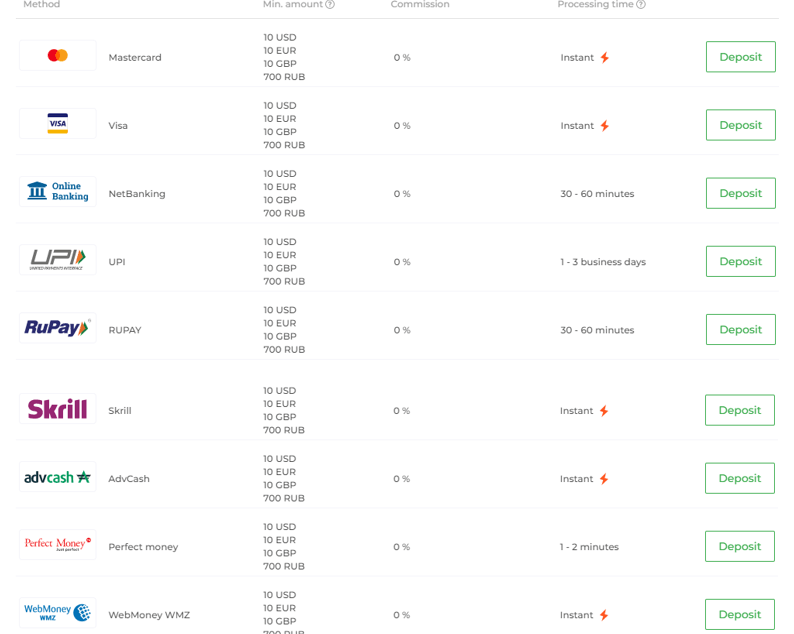

How to deposit

IQ Option offers convenient ways to deposit funds that include various electronic payment systems, wire transfer options and bank cards. Look at the images below to know about the different deposit methods of IQ Option

How to withdraw

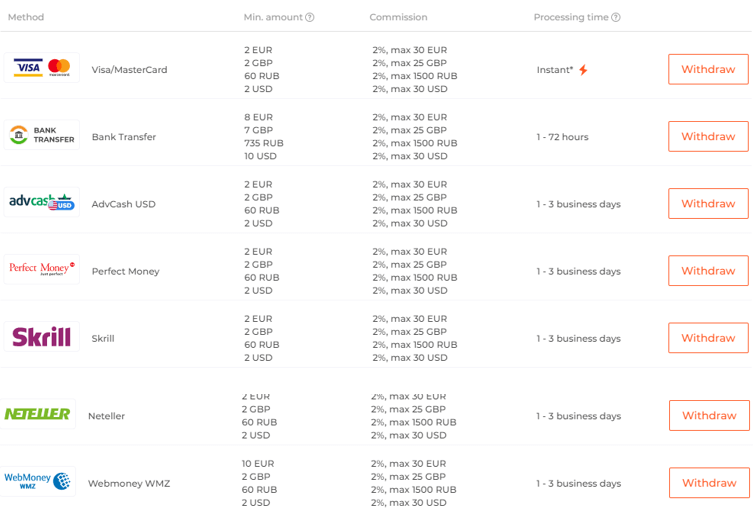

Like deposit, IQ Option also offers easy ways to withdraw funds including credit and debit cards, wire transfer options, and electronic payment systems. Clients are charged a fee of $31 or an equivalent amount in another currency for each withdrawal of funds via bank transfer, but they can have free withdrawal once in a month and it does not depend on which payment method they are using. IQ Option withdrawal method details are given below

IQ Option Trading Guides

How to trade on IQ Option?

To trade with IQ Option, you must open an account first by providing personal details. If you are a beginner, it is recommended to open a demo account first to practise your trading strategies. Afterwards, you may open a real account and proceed to the trading platform.

How to start with Binary Options?

Binary option trading is involved with predicting if an underlying asset would go up or down. There are only two outcomes in this trading; the trader either wins or loses. It is different from traditional options. Therefore, it has different fees, payouts, and risks. If a trader is looking for hedging or speculating, binary options are a good substitute to make predictions on assets. You need to learn and understand three key features of binary options trading

- Strike price: It refers to the price at which you can exercise a call or put option. For instance, the current price of gold may be $1,500 while the winning trade receives 80% of return. Let’s assume that the trader places an “up” bid with $100. When the contract closes and the price of gold increases, the trader can get back to their $100 along with 80% of placed amount. In this scenario, the trader would have $180 at the end. If the prediction was wrong, the trader would lose the $100 they put in the option.

- Payout offer: A payout offer is a return. It is usually offered in percentage by the broker to traders. In the gold example mentioned in the previous point, the offer is 80% when it is a successful trade. The maximum loss potential here is limited to the amount the trader invests in the option. However, some traders may give up an offer for a loss up to 10%. As a trader, you must know these percentages before you place your bid.

- Expiry time: This is the period between buying the option contract and closing it. The expiry time can range between one minute and one month. Generally, most traders prefer short term options lasting from 60 seconds to 30 minutes.

How to start with Digital Options?

Digital options are a new trading tool developed by IQ Option that combines features of classic and binary options. It offers an opportunity to trade various assets. The profitability and the risks of each trade would depend on a manually chosen strike price.

To trade digital options, an investor must take these necessary steps

- Select the desired asset.

- Choose the expiration period.

- Determine the amount they want to invest.

- Choose a strike price.

- Click “Call” if they believe that the price will go up, or click “Put” if they think that the price will go down.

- Wait for the expiration time to come or sell the option prematurely.

So, there are three basic parameters apart from the asset type that you have to adjust while getting into digital trading. Those are the strike price, the amount invested, and the time period. However, there are a large number of available strategic options. Based on different aspects, some traders consider it not a wise choice to opt for a strike price too far away from the current price level if in their opinion; the price is not going to reach the desired level. On the contrary some trades are ready to take the additional risk to chase higher returns, and they go for a higher or lower strike prices.

Keep in mind that digital options expire in the money only if the actual price is not the same as the strike one. It should exceed the strike price by at least one pip for call options. However, it should fall behind the strike price by at least one pip for put options.

How to trade CFDs?

CFD stands for “Contract for difference”. It is a great way to trade shares without turning to shares themselves. The hassles involved in stock trading can be avoided easily while trading options. While stock brokers do not offer a vast range of investment assets, IQ Option allows you to trade equity, cryptocurrencies, and currency pairs.

This is how you can trade CFDs on stocks on IQ Option

- Choose stocks: First, click the button “Open New Asset” that is at the top of the screen. Then, select “Stocks” from the list. Afterwards, you have to choose the company you wish to trade. You may use technical analysis tools to analyse the price chart. Remember to take fundamental factors into account as well. Then, determine the direction of trend and predict its future behaviour.

- Set the amount: Next, you have to set the amount you want to invest in the particular trade. Keep in mind that according to prominent risk management practices, you cannot allocate the entire capital on to a single trade.

- Choose a multiplier and set auto closing: A multiplier increase the potential return but it also increases the risk involved. If you open a position worth $100 with x5 multiplier, you will get the results of a $500-worth position. It is applied to both profits and losses. With auto closing, you will be allowed to close the position automatically, whether you want to grab your profits or manage your losses.

- Choose “Buy” or “Sell”: Now, you need to choose either “Buy” or “Sell”, based on your forecast. Close the position when it is the right time. If the trend direction was predicted right, then the bigger the difference between the opening price and the current price, the higher the potential profit would be. Do not keep the position open for too long because your position would be subject to an overnight fee.

How to start with Forex?

Forex is the short form for foreign exchange and it is also referred to as FX often. The forex market is the largest and most liquid market in the world. This market does not set an absolute value for a currency. However, it decides its relative value against another currency.

When a trader opens a position of forex on the trading platform of IQ Option, they make a prediction involving price development. If the prediction is correct, they can benefit from it. This is why a trader must learn analysing the chart in an effective way.

You can find a lot of information about any asset on the IQ Option platform by clicking on the “Info” button under the name of the asset. After that an entire section opens with information and analysis on the asset. You can find general information about the currency pair, technical analysis and economic events, trading conditions, and important news affecting the price there.

However, keep in mind that this analysis must not replace your own analysis. Still, it can be useful sometimes when you need to make a well-informed decision. Apart from the analysis provided in the “Info” tab, you can also use the graphical tools and indicators in the traderoom.

Forex is a complex tool. So, you can use the practice balance to learn your approach and get better at it. If you are beginner, it will also help you to implement a powerful risk management technique.

Strategies

How to use News

Financial and political news is very important when it comes to trading because it influences the price movements of the instruments to a great extent. So, you need to use news carefully to make the right trading decisions.

How to read economic calendars

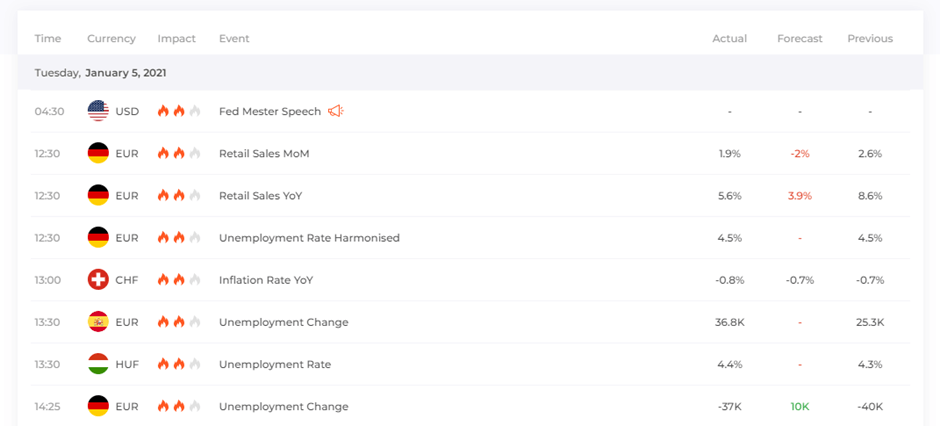

The economic calendar displays all major financial events all around the world. It helps traders understand the market movements at any given moment. News like speeches from national leaders, reports of unemployment, GDP and oil resources forecasts and inflation indices influences the attitudes of market participants. This is why every trader needs a sound economic calendar. IQ Option offers a useful economic calendar and you may follow these steps to read it

- Visit the official webpage of IQ Option and click on “Calendars” under “For Traders” tab. The page of the economic calendar will open.

- At the top left corner of the page, you can see the date and current time. At the top right corner, there is an option of filters beside the 7-day date range of the calendar.

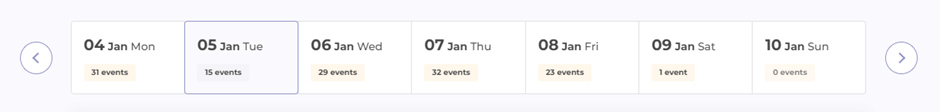

- Just below the top row of date, time and filters, you can see the dates of 7 days and the number of events each day. The date of the current date is marked.

- The economic calendar of the current date is displayed below this. You can see the time, currency, impact, and event here. The previous, forecast, and actual statistics of the event are given here as well.

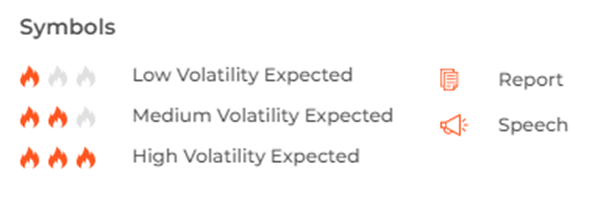

- At the bottom left corner of the page, you can see the symbols used in the chart along with their meaning. This table will help you to read and understand the events on the economic calendar better.

Indicators

IQ Option offers an array of technical indicators so you can create thousands of trading strategies. Indicators you may use on this platform are

RSI

The Relative Strength Index or the RSI is one of the momentum oscillators that traders use to measure the magnitude and velocity of directional price movements. It offers sell signals to the investors when the asset is overbought; and offers buy signals when the asset is oversold.

To use the RSI indicator in trading, you need to note the point that the indicator oscillates between 0% and 100%. Traditionally, it is considered oversold when below 30% and overbought when above 70%. If it offers a high number of false alarms, the overbought threshold can possibly be increased to 80 and the oversold threshold can possibly be decreased to 20.

The developer of the indicator, J. Welles Wilder recommends a smoothing period of 14 that can be changed for the purposes of long-term and short-term strategy adaptability. Longer or shorter periods are used for longer or shorter outlooks alternately.

As a universal indicator, the RSI can be used to trade any assets including currency pairs, indexes and derivatives.

MACD

Moving Average Convergence/Divergence or the MACD is a trend-following momentum indicator developed in the late 1970s by Gerald Appel. This effective momentum oscillator is suitable for identifying entry and exit points. The MACD offers corresponding signals in the beginning and also at the end of the trend.

Due to the complex nature of MACD, you can use it in many ways, such as

- Signal line crossovers: You can expect an uptrend with the fast line turns up and crosses above the slow line. When the opposite happens and the fast line crosses below the slow line, you can expect a downtrend.

- Canterline crossovers: An uptrend can be expected when the fast line turns positive after moving above the zero line. Similarly, a downtrend can be expected when the fast line turns negative as it moves below the zero line.

- Divergences: Divergences take place when the MACD chart and the price chart display movements in opposite direction. When the MACD forms a higher low and a security records a lower low, a bullish divergence forms. On the contrary, a bearish divergence is formed when the MACD line forms a lower high and a security records a higher high. Divergence usually indicates an upcoming trend reversal.

Bollinger Bands

Bollinger Bands is another technical analysis indicator that predicts the future behaviour of a price chart excellently. This indicator is a combination of a moving average and two accompanying bands. The bands are one standard deviation away from the moving average. To put it simply, the higher the price volatility, the further away are the bands from the MA.

In other words, the bigger the standard deviation, the wider the price range is of an underlying asset a given period. When you try to predict future price movements, it is helpful to measure how far the price can deviate from its average value.

To use Bollinger Bands in day trading effectively, you must understand the basics of price volatility and its applications in trading. As per rule, high volatility periods are usually intermingled with low volatility periods. In the uptrend, the price usually lies between the middle line and the upper band. On the contrary, in the downtrend, the price generally fluctuates between the average line and the lower band.

The chances for an upcoming boost of volatility are higher if the market stays still for a longer period. Bollinger Bands can pinpoint these moments easily. By using this indicator, you can predict future volatility fluctuations and decide oversold or overbought positions by opening trades at the most expedient moment. However, you must not forget that no indicator is 100% accurate and they can also provide false signals.

When the asset leaves the normal price range, most risk-averse traders stop opening new positions until the market is stable again.

Rainbow pattern

The rainbow pattern uses three exponential moving averages with different periods. It starts with the period of six of blue colour, followed by the period of 14 of yellow colour, and at third, comes the period of 26 of red colour.

Moving averages

The Moving Averages or the MA is the most popular technical analysis tool on the IQ Option platform because it is not only simple but also effective. The main function of this indicator is reducing the price noise as well as smooth out the price action. The general concept of the indicator can be represented by four different types.

Simple Moving Average (SMA) and Exceptional Moving Average (EMA) are the most commonly used variations of the indicator. SMA is the average of the asset prices within a set period, while EMA focuses on recent prices and assigns them to bigger weights. Weighted Moving Average (WMA) gives the most importance to the most recent candlestick. Lastly, Smoothed Simple Moving Average (SSMA) is rarely used in trading and it does not focus on a specific period.

Although MA is a basic technical analysis tool, it has many practical applications in trading. Recognizing the existing trend is the most common application among them. The moving average allows the trader to look beyond random price fluctuations by reducing the noise and smoothing the price action.

Traders can also use the moving average as a dynamic support and resistance line. When the price touches the MA from above, the trader may want to buy the asset, but when the asset price touches the MA from below, it may be a wiser option to consider selling the asset.

Trend line break pattern

Plotting the trendlines of a security on a chart is a very easy way for traders to get an idea of the asset’s trend or direction. Trendlines come in various forms, and they also vary in significance and length. For better trading, you need to understand how you can use stop-loss strategies while trading technical signals based on breaks of support and resistance.

Piercing pattern

The piercing pattern is a two-day candlestick price pattern. It marks a potential short-term reversal from a downward trend to an upward trend. It includes the first day opening near the high followed by the closing near the low with an average of large sized trading range. Apart from this, the pattern also includes a gap down after the second day when trading begins on the second day. This time, it opens near the low and closes near the high. The candlestick on the close should cover minimum half of the upward length of the red candlestick body from the previous day.

Three black Crows pattern

Three consecutive bear candles developed at the end of a downtrend form the three black crows pattern. The open of one candle is at the same level or a bit higher than the close of the previous candle. The development of a strong downtrend is indicated by this.

The three black crows pattern generally forms when there is high volatility in the markets. For example, when a piece of news is released and results in a strong uptrend, the three black crows usually start forming and the trend suddenly reverses while driving prices down again.

How to use IQ Option tutorial to improve your trading strategy

You need to go through the PDF tutorial and watch the video tutorials first so you can learn better about trading. Afterwards, you can practise trading in your demo account. After practising, if you think you have gathered enough confidence, you can get into live trading with real money. However, you must keep in mind that all the resources on the website are for learning purposes only. Also, take note that high number of risks is involved with binary options trading. You may end up losing your money from unprofessional trading. These tutorials are only for you to learn the purpose of the trading platform.

FAQs

IQ Option offers PDF tutorial package and video tutorials on trading that you can go through and watch. Those tutorials will help you learn options trading.

IQ Option offers demo account apart from real accounts. If you are a beginner, you should open a demo account first where you can practise your strategies. The broker also offers guides and tutorials so beginners can learn how to trade quickly.

IQ Option operates in more than 150 countries and has more than 100 million registered users.

The minimum deposit for IQ Option is $10.

RISK WARNING: YOUR CAPITAL MIGHT BE AT RISK

For more please read IQ Option Review